Getting The Eb5 Immigrant Investor Program To Work

Table of Contents5 Simple Techniques For Eb5 Immigrant Investor ProgramRumored Buzz on Eb5 Immigrant Investor ProgramIndicators on Eb5 Immigrant Investor Program You Need To KnowLittle Known Questions About Eb5 Immigrant Investor Program.The 8-Second Trick For Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program Fundamentals Explained

Regardless of being less prominent, various other paths to obtaining a Portugal Golden Visa include investments in financial backing or private equity funds, existing or brand-new company entities, capital transfers, and contributions to sustain clinical, technical, artistic and cultural growths. Owners of a Portuguese resident authorization can also work and study in the nation without the need of getting extra permits.

How Eb5 Immigrant Investor Program can Save You Time, Stress, and Money.

Capitalists have to have both an effective entrepreneurial history and a significant organization record in order to use. They may include their spouse and their kids under 21-years- old on their application for irreversible house. Successful candidates will certainly receive a sustainable five-year reentry permit, which allows for open traveling in and out of Singapore.

Eb5 Immigrant Investor Program Things To Know Before You Buy

Applicants can invest $400,000 in federal government approved genuine estate that is resalable after 5 years. Or they can spend $200,000 in federal government authorized actual estate that is resalable after 7 years.

This is the major advantage of coming in to Switzerland compared to other high tax nations. In order to be eligible for the program, applicants must Be over the age of 18 Not be used or occupied in Switzerland Not have Swiss citizenship, it needs to be their very first time staying in page Switzerland Have rented or bought house in Switzerland Offer a long checklist of identification documents, consisting of clean criminal record and great moral personality It takes around after settlement to obtain a resident permit.

Rate 1 visa holders continue to be in condition for about 3 years (depending on where the application was submitted) and should apply to prolong their keep if they desire to proceed living in the United Kingdom. The Rate 1 (Business Owner) Visa is valid for 3 years and 4 months, with the option to extend the visa for another two years.

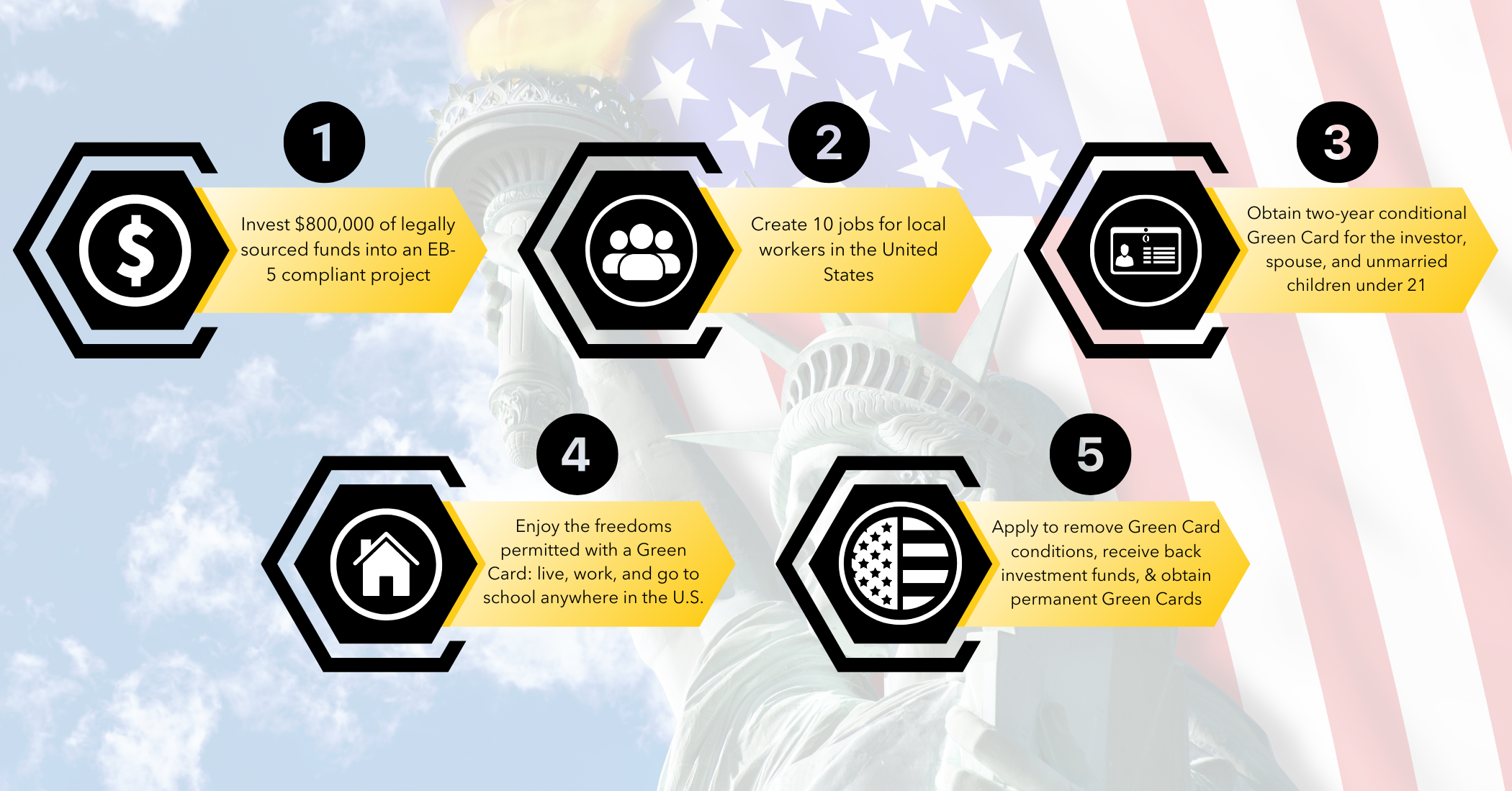

Investment immigration has gotten on an upward trend for greater than 20 years. The Immigrant Financier Program, likewise called the EB-5 Visa Program, was developed by the united state Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its key function: to stimulate the U.S. economy via job development and resources investment by international investors.

This consisted of reducing the minimal investment from $1 million to $500,000. With time, modifications have actually raised the minimum financial investment to $800,000 in TEAs and $1.05 million in other areas. In 1992, Congress looked for to enhance the impact of the EB-5 program by presenting the Regional Facility Pilot Program. These privately-run entities were marked to advertise economic development and task production within particular geographical and sector markets.

Get This Report about Eb5 Immigrant Investor Program

Visas are "scheduled" each monetary year: 20% for rural, 10% for high unemployment, and 2% for infrastructure. Unused books rollover to the next year. Developers in country locations, high unemployment locations, and infrastructure projects can gain from a devoted pool of visas. Investors targeting these specific areas have actually a raised possibility of visa availability.

Developers servicing public works jobs can now qualify for EB-5 financing. Financiers now Extra resources have the chance to purchase government-backed framework tasks. Certain USCIS analyses under previous law are locked in by law, including forbidden redemption and financial obligation plans, and talented and loaned mutual fund. Developers need to ensure their financial investment setups comply with the new legal meanings that impact them under U.S.

migration law. EB5 Immigrant Investor Program. Financiers should understand the approved types of financial investment funds and arrangements. The RIA has developed demands for issues such as redeployment, unlike before in prior versions of the law. Investors and their families currently legally in the U.S. and qualified useful site for a visa number might concurrently file applications for change of standing along with or while awaiting adjudication of the investor's I-526 petition.

This simplifies the process for investors currently in the United state, expediting their ability to readjust standing and preventing consular visa handling. Investors looking for a quicker handling time might be a lot more likely to spend in rural projects.

Eb5 Immigrant Investor Program - Truths

Trying to find U.S. government details and solutions?

The EB-5 program is a possibility to produce jobs and boost the U.S. economic climate. To qualify, applicants have to purchase new or at-risk companies and create permanent placements for 10 certifying staff members. The united state economic situation benefits most when an area is at threat and the brand-new financier can offer a functioning facility with complete time work.

TEAs were applied into the financier visa program to motivate spending in locations with the biggest requirement. TEAs can be country locations or locations that experience high joblessness.